P.E.O. Foundation

The P. E. O. Foundation is not a project but rather a service to the P. E. O. Sisterhood that benefits all of the projects.

The P. E. O. Foundation is a nonprofit corporation established in 1961 to encourage tax-deductible giving to the educational and charitable projects of the P. E. O. Sisterhood. Because it qualifies as a charity under Section 501(c)(3) of the Internal Revenue Code, gifts and bequests to the Foundation are deductible for the United States and state income, estate and gift tax purposes. Gifts to local or state chapter funds are not tax-deductable for because these entities are not qualified charities.

For more information on the P. E. O. Foundation and how to contribute to it, go to the P. E. O. Foundation page on the International Website or click on the P.E.O. Foundation logo above. You will need to login to the International website as usual.

Please direct all questions or requests to the Trustee for your state. When emailing, please include “P. E. O. Foundation” in the subject line. The P. E. O. trustee assigned to Kansas is Julie Stroh.

Julie Stroh

Secretary

jstrohpeo@gmail.com

Newsworthy Celebration!

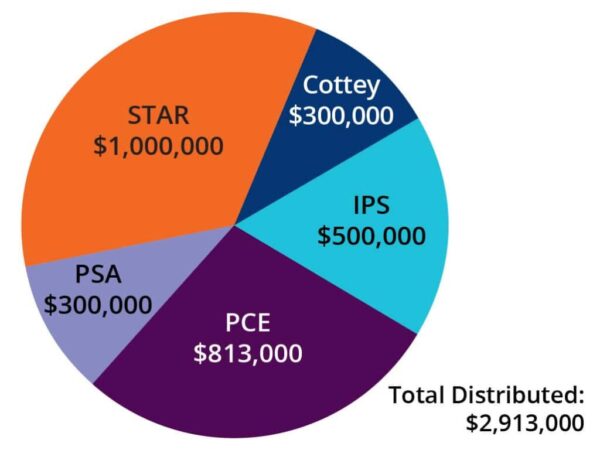

Every year, the P.E.O. Foundation trustees distribute money donated to the Undesignated Fund to each of the six P.E.O. projects. This money has a huge impact on the overall support P.E.O. can offer to help women reach their educational goals. In 2025, over $2.9 million was distributed from the P.E.O. Foundation Undesignated Fund.